Fast-growth, high risk and why bailed-out energy company Bulb was over in a flash

Ben Ellery

Saturday November 26 2022, 12.01am, The Times

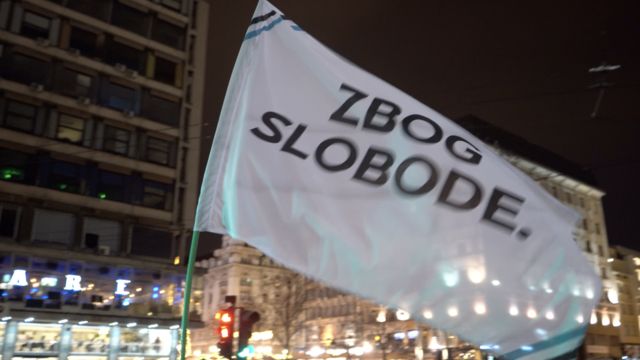

Hayden Wood and Amit Gudka, the co-founders of the energy firm Bulb, whose green credentials chimed with consumers

JOHN NGUYEN/JNVISUALS

It was an office party from hell — the company’s founder and chief executive was the DJ, and staff felt forced to nod their heads in time to the music.

Hayden Wood, the man operating the turntables, was enjoying the moment, revelling in the plaudits handed to him as chief executive of Europe’s fastest growing company: the now failed energy firm Bulb.

After a swift rise to become a £350 million company, Bulb’s fall from grace has been spectacular. It had to be bailed out by the government at a cost of £6.5 billion, the equivalent of nearly £230 from every household in Britain and the biggest rescue package since the Royal Bank of Scotland.

A former senior member of staff has told The Times that the founders, Wood, 39, and Amit Gudka, 38, fostered a hubristic company culture that made them unable to see the huge risks to which they were exposed.

Despite leaving the taxpayer with a vast bill, the founders remain unscathed. Wood has a plum job at a venture capital firm, and Gudka, who left Bulb before the bailout, owns a £2.5 million house with Farhana Bhula, his film executive wife, in Hackney, east London. Wood, a privately educated management consultant, and Gudka, a former Barclays energy trader, extracted £4 million each from Bulb by selling shares in a 2018 fundraiser. Wood was still drawing his £250,000 annual salary five months after the company went into administration.

The pair first met in 2012 and set up the company two years later, quickly building an impressive reputation within the industry by offering renewable energy more cheaply than the big six suppliers.

It rapidly expanded from a start-up and was fêted by the City as its customer base grew to 1.7 million households. Its green credentials spoke to the concerns of customers who were worried about the climate, and amid its growth it upgraded its offices from a shared office space in east London to a new development next to Liverpool Street station, enhanced with thousands of pounds worth of plants.

However, staff at the company were anxious that the rate of growth was unsustainable, and said that towards the end of Gudka’s time with the company he had started to fall out with Wood.

One senior staff member said: “When we started, it was a small team that was genuinely passionate about green issues, but that changed when we started making serious money.

“It was a very trendy tech start-up. We would do team-building exercises like painting and pottery classes. Each staff member was given £30 each month for company social events.

“The worst part was Hayden would insist on DJing at staff parties. It was really awkward because the music was quite odd. Nobody wants to party with their boss but he didn’t seem to understand. Amit actually ran a record label and was a DJ but he didn’t perform, it was just Hayden.

“Working for Bulb was a bit like a cult. We had to go into a weekly group meeting and shout slogans such as ‘No carbon’. The company had so much money that we were given extraordinary bonuses. Staff who were earning £28,000 a year were able to clear £4,000 a month with their bonuses.”

Bulb’s fate was sealed by the risky policy that had allowed it to become so big in the first place.

Unlike most established energy companies, Bulb did not buy its wholesale energy many months in advance — a process known as hedging, which allows suppliers to mitigate the impact of market volatility.

As a result, when wholesale prices were falling it was able to undercut competitors by buying energy more cheaply at short notice. However, as energy prices soared during the pandemic it was left exposed to higher short-term prices whereas its competitors had locked in cheaper energy. Bulb was unable to recoup these higher costs from its customers because of Ofgem’s energy price cap, which is based on the costs suppliers would face if they hedged.

Farhana Bhula, the wife of Amit Gudka, is a senior executive at Channel 4’s Film4

“There was such relentless optimism within the company and there was never a sense of how much risk we were exposed to,” the staff member added.

“There was talk of expanding into other countries — the founders wanted 100 million customers by 2030. It was just hubris.

“We lost our company values. The initial model had been hiring young people who were straight from university and were passionate about the climate. But by the end the company was so big that we just hired anyone and there was a real divide between the new and old staff.

“The staff were twentysomethings because they were cheap, so there was no one experienced to say, ‘We need to be careful’.

“It used to be quite an open company but as things started to fall apart everything felt very secretive. The writing was clearly on the wall but it felt like it was being kept from us.

“Amit, who I think was actually quite a decent guy, left — there were rumours of a falling out with Hayden. To me, Hayden was more concerned with making money than making a difference to the climate. He continued at the firm and in my view he should be in prison for what has happened. There should be a law against it. The profits went to the company bosses while the losses were taken on by the taxpayer.”

There is no suggestion that Wood has committed a crime.

Gudka, who left Bulb in February last year, is a grime and dubstep DJ in his spare time

Wood and Gudka’s stakes were both valued at more than £100 million at the last funding round but the collapse has wiped out much of their fortunes. Gudka left the company in February last year.

Wood now works at the venture capital firm Giant Ventures, which claims he is “one of Europe’s most experienced climate technology entrepreneurs”. Cambridge-educated Gudka, who is a grime and dubstep DJ in his spare time, is running a battery storage business.

By the time Bulb was bailed out by the government a year ago it had 855 staff. Octopus is now in the process of buying the company.

There is widespread confusion within the industry as to why the figure to rescue Bulb by the taxpayer is so high.

Experts say the figure, revealed by the Office for Budget Responsibility (OBR) last week, is bizarre, and neither the government nor the company has been willing to shed any light on why it is so much.

A spokesman for the OBR said: “Our understanding is that this is additional operating costs that have gone on for longer than expected previously.”

Last night Wood said: “I’m very sorry for the way things turned out. I’m disappointed in the outcome, and did everything I could to avoid it, and protect consumers and taxpayers.

“This has been an extremely challenging time for the energy industry, with 29 suppliers failing since the beginning of the crisis. While I was still at Bulb, I worked extremely hard with my team to minimise costs to the taxpayer, protect jobs and continue serving our customers.”

Gudka told The Times: “I left Bulb in February 2021, at which time the company had a six-month hedging policy in place and a fully audited set of results had just been completed on a going concern basis.

“Whilst I did not leave until February 2021, I first informed the board of my intention to leave in January 2020.”

A government spokesman said: “We understand that Bulb customers want certainty at this time and we are working hard to make sure we continue to secure the best deal for everyone involved. This includes ensuring we secure the best value for taxpayers and approving a deal where we expect the net cost for taxpayers to be significantly lower than the figure forecast by the OBR.”

How much is the Bulb bailout costing?

The Office for Budget Responsibility (OBR) said “the total cost of the Bulb Energy bailout has reached £6.5 billion”, based on Treasury estimates, or more than £230 for every British household (writes Emily Gosden). The final cost would be “significantly lower”, the government said, because of the undisclosed terms of a deal to sell Bulb to Octopus Energy.

How much was it expected to cost?

A lot less. The government had previously budgeted £1.2 billion to fund Bulb in the year 2021-22, of which £900 million was actually spent, and had budgeted £1 billion for 2022-23. However, in the autumn statement the estimate for 2022-23 unexpectedly jumped up to £5.6 billion. This was especially surprising given a court heard this month that the administrators running Bulb had accessed less than £1.2 billion of a £1.7 billion loan the government had made available to them.

What could have pushed up the cost estimate?

The Treasury barred Bulb’s administrators from “hedging”, or buying gas and electricity months in advance. Most companies hedge in line with a formula used by Ofgem when setting the price cap, which determines the costs they can recoup. Bulb’s administrators have instead been left to buy energy at short-notice prices, which may be higher or lower. Industry experts have long warned that this decision risks inflating the costs of running Bulb if it has to pay higher prices that it cannot recoup. Analysts believe that this could run to several billion pounds in a worst-case scenario. However, Martin Young, an analyst at Investec, said he did not believe that costs incurred by not hedging could have added up to £5.6 billion this year — or more than £3,700 for every Bulb customer.

And the Octopus deal?

The government has agreed a deal to sell Bulb to Octopus under undisclosed terms. They are believed to include the government stumping up at least £1 billion in the short term to enable hedging for Bulb’s customers to be put in place at the point the deal completes, with this sum being repaid when the energy is used. The government said that the figures cited by the OBR “do not include the financial support that will be repaid”. Yet the increase to the bailout estimate is far more than £1 billion, leading to speculation that the government liabilities incurred through the deal could be higher than expected.

by Летећи Полип Wed Oct 12, 2022 2:09 pm

by Летећи Полип Wed Oct 12, 2022 2:09 pm

Erős Pista

Erős Pista