Ћина-Средње Краљевство

- Posts : 22555

Join date : 2014-12-01

- Post n°177

Re: Ћина-Средње Краљевство

Re: Ћина-Средње Краљевство

I for one salute our new chinese overlords!

- Guest

- Post n°178

Re: Ћина-Средње Краљевство

Re: Ћина-Средње Краљевство

China’s Bid to Upend the Global Oil Market

Could a new oil futures contract mark a seismic shift in Beijing’s efforts to globalize its currency?

By Keith Johnson | January 18, 2018, 11:42 AM

Sometime soon, after the close of the Chinese New Year, officials in Shanghai will flip the switch and start trading in an arcane new financial product — one that could presage a huge shift in global energy markets and advance China’s quest to play a bigger role in the global economy.

After years of false starts, a long-awaited Chinese oil futures contract will make its debut on the Shanghai Futures Exchange, likely in late March. It will be the first crude oil benchmark in Asia, which is important because that’s where oil consumption is growing the most. And it will be the first contract priced in Chinese currency, known as the renminbi or yuan. Currently, the main global benchmarks for crude oil are in New York and London — and priced in dollars.

If the new contract gains traction among international oil companies and traders — still a big if, given Beijing’s habit of meddling with financial markets and its currency — it could go a long way toward righting the energy market. In recent years, a seismic shift has taken place as China has dethroned the United States as the world’s biggest oil importer, yet that’s not really reflected in the commodities market.

“For the oil market, it shows how the center of gravity is shifting to Asia. It means the U.S. is not front and center in the oil market anymore,” said Matt Piotrowski of Securing America’s Future Energy, a nonprofit focused on U.S. energy security.

The contract, dubbed the “petroyuan,” is one small part of China’s yearslong on-again, off-again bid to make its currency a bigger player on the global stage.

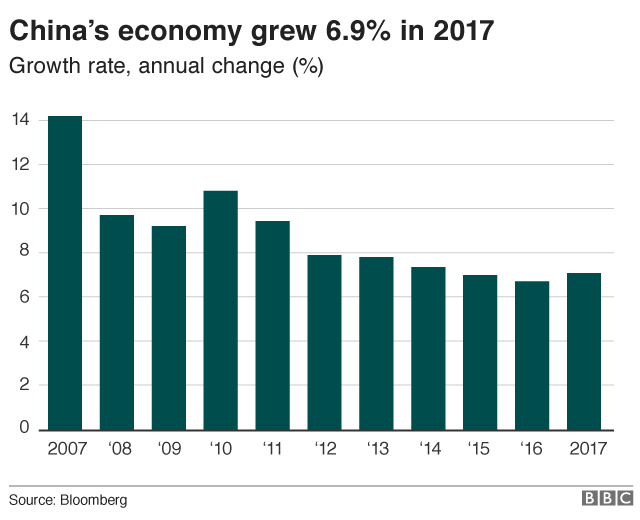

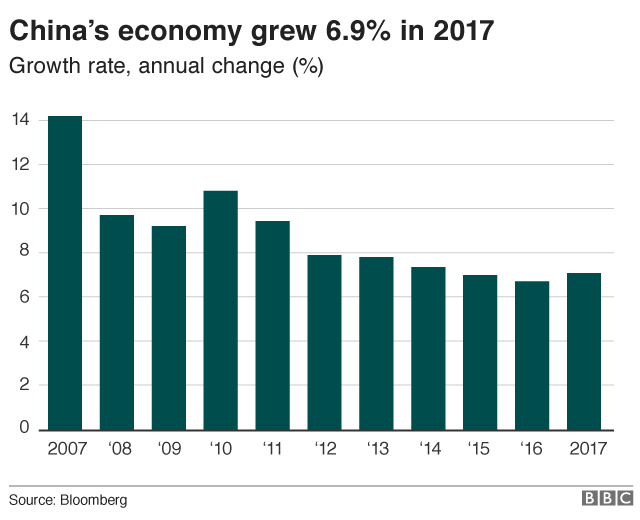

Even though China’s economy has grown tenfold this century to become the world’s second largest, the global financial system is still dominated by the dollar, the euro, and the yen, reflecting Beijing’s previous bit-player status. China’s ultimate goal is to translate its growing economic might into levers of real influence that come with having a globally used currency like the dollar today or the pound sterling in decades past.

That push seemed to be making great strides, with a growing share of cross-border trade settled in renminbi rather than yen or dollars, and with the yuan making inroads into overseas capital markets, including London. A symbolic boost came in late 2015, when the International Monetary Fund agreed to include the yuan in its basket of global currencies, a sign it was shedding its poor-cousin status.

But then progress stalled. The yuan plunged in value, even as Beijing redoubled efforts to prop up the currency, interfering to tamp down volatile financial markets and regulating the flow of capital. That dampened the international appeal of holding the yuan and seemed to mark an inflection point in Beijing’s quest to internationalize the currency, said Barry Eichengreen of the University of California, Berkeley, who has written extensively on the topic.

“In fact, the Chinese have been moving in the opposite direction since the financial volatility of 2015, and as a result the yuan has been losing ground as a currency in which to invoice trade, settle cross-border transactions in general, and hold reserves,” he said.

Lately, though, there have been indications that the yuan is starting to claw back some ground.

The government has slightly loosened its micromanagement of the exchange rate, and the currency hit a two-year high against the dollar this week.

The yuan seems to be regaining prominence in cross-border trade after falling out of favor for a couple of years. And new regulations are meant to spur that trade even further, by making it easier for Chinese and international companies to do business in yuan. Pakistan, a big economic partner of China, is toying with conducting all bilateral trade in yuan rather than in dollars. China is even using yuan rather than dollars to buy physical cargoes of oil from countries like Russia — and hopes to do the same with its other major supplier, Saudi Arabia.

And banks are also snapping up yuan for their currency reserves, a sign of the renminbi’s slowly growing acceptance as an international currency: Banks’ holdings of the yuan passed the $100 billion mark late last year, though it remains far behind global stalwarts like the dollar, euro, yen, and pound. The European Central Bank, which had already set up a currency swap line with the People’s Bank of China to grease two-way trade, just revealed that it dumped 500 million euro worth of greenbacks to add yuan to its reserves last fall; the Deutsche Bundesbank followed suit earlier this month.

Now comes the oil futures contract, a milestone that’s been in the works for years but that was repeatedly delayed by volatile markets and concerns about Chinese state interference in capital markets.

The contract will feature the kind of oil that makes up a big share of Chinese consumption — typical Middle Eastern grades known as “medium sour” — rather than the U.S. or British crude that has dominated global pricing for decades. That’s important because it could help bring the world’s biggest commodity market more in line with the changing physical realities on the ground.

“It makes increasing sense to have an Asian benchmark given where demand growth is going to be found in coming years,” said Ole Hansen, head of commodity strategy at Denmark’s Saxo Bank, who has been following the launch of the petroyuan closely. In the last couple of years, China has passed the United States as an oil importer, buying up to around 8 million barrels a day.

In years to come, if the contract is a success, millions of barrels a day of oil could be priced in yuan rather than in dollars, Hansen said, “which would further increase China’s importance on the global stage, while further eroding the importance of the dollar.”

It’s not at all clear the oil contract will make quite that big a splash. Commodities experts, including Hansen, expect a slow takeoff as oil companies and traders wait to see if the contract attracts enough participants to provide the kind of market liquidity that makes for a global benchmark.

Initially, said Piotrowski of SAFE, it might be most attractive to small, independent Chinese refiners — known as “teapots” — who could hedge their financial risk of buying oil by doing business in their own currency rather than in dollars.

What’s more, China’s meddling with the currency and capital markets could spook some international financial players used to the wide-open markets in New York and London.

The yuan contract is “small potatoes, mainly of symbolic value,” Eichengreen said.

He added that the seeming shift away from the dollar’s stranglehold on the oil market is less revolutionary and more a return to how things used to be.

“We’ve seen a world before where several national currencies are used in oil market transactions,” he said, noting that decades ago the dollar and pound were both widely used.

Ultimately, though, if China hopes to throw its weight around in the energy market and make the petroyuan a big success, Beijing will have to make the kind of far-reaching reforms it has so far resisted making in order for the yuan to become a global currency. That includes allowing the currency to float freely and removing limits on capital flows — still risky moves for a government that micromanages economic policy.

“China would have to substantially eliminate restrictions on international financial transactions in order for the renminbi to become a leading reserve currency,” Eichengreen said. Instead, “it continues to tighten restrictions.”

https://foreignpolicy.com/2018/01/18/chinas-bid-upend-global-oil-market-petroyuan-shanghai/

- Posts : 10694

Join date : 2016-06-25

- Post n°179

Re: Ћина-Средње Краљевство

Re: Ћина-Средње Краљевство

Report to Congress on China's WTO compliance:

The likely upcoming US attack on China trade policies is apt to have broader bipartsian support than many other US trade measures.

- China's Industrial policies;

- technology transfer;

- Investment restrictions;

- subsidies;

- excess capacity;

- reexport restraints;

- Import bans on remanufactured products;

- import ban of recoverable products;

- government procurement;

- Intellectual property rights, trade secrets;

- bad faith trademark registration;

- pharmaceuticals;

- online infringements;

- counterfeit goods;

- electronic payment services;

- theatrical films; banking services;

- insurance services;

- securities and asset management services;

- telecom services;

- internet services;

- audio visual services;

- legal services;

- beef, pork and poultry;

- biotechnology;

- agricultural support;

- publication of trade law transparency;

- administrative licensing;

- and competition policy

"For more than 15 years, the United States has relied on cooperative highlevel dialogues to effect meaningful and fundamental changes in China’s stateled, mercantilist trade regime. These efforts have largely failed. Accordingly, the United States intends to focus its efforts on enforcement going forward. These efforts will include not only use of the WTO’s dispute settlement mechanism to hold China strictly accountable for adherence to its WTO obligations, but also other needed mechanisms, including mechanisms available under U.S. trade laws. The United States is determined to use every tool available to address harmful Chinese policies and practices, regardless of whether they are directly disciplined by WTO rules or the additional commitments that China made in its Protocol of Accession to the WTO. The United States will not accept any Chinese policies or practices that are unfair, discriminatory or mercantilist and harm U.S. manufacturers, farmers, services suppliers, innovators, workers or consumers. Americans have waited long enough. The time has come for China to stop its market-distorting policies and practices and finally become a responsible member of the WTO."

The likely upcoming US attack on China trade policies is apt to have broader bipartsian support than many other US trade measures.

- Posts : 10694

Join date : 2016-06-25

- Post n°180

Re: Ћина-Средње Краљевство

Re: Ћина-Средње Краљевство

Odlazi se na poklonjenje novim gazdama

- Posts : 10694

Join date : 2016-06-25

- Post n°181

Re: Ћина-Средње Краљевство

Re: Ћина-Средње Краљевство

Railway project involving 1,500 workers completed in less than 9 hours

- Posts : 10694

Join date : 2016-06-25

- Post n°182

Re: Ћина-Средње Краљевство

Re: Ћина-Средње Краљевство

China Expresses Dissatisfaction Over EU’s Tariffs on Steel

- Posts : 10694

Join date : 2016-06-25

- Post n°183

Re: Ћина-Средње Краљевство

Re: Ћина-Средње Краљевство

Kakv olos ako je tacno, oni hoce da odredjuju sta ce Kinezi da rade na svom trzistu a nije im smetalo kada su uletali na njihvo trziste onda JV nije smetao ali sada kada su Kinezi dostigli tehnoloski nivo postaje problem.

Dakle, oni se bune sto su ih Kinezi dostigli u mnogim tehnoloskim sektorima i sada ih prestizu iako su sami pristali na to

Nadam se da ce ovo konacno ubediti elite rusije i kine da prestanu flert sa doticnim zbog sopstvenih privilegija, koje ce izgubiti svakako, i da se krene u ono sto mora da se uradi i zavrsi brzo sa time jer je ionako suvise korumpirano i jadno.

Uzgred, ovo pokazuje da su Kinezi radili skoro sve suprotno od Srbije u razvoju...

Japan media reporting that US/Japan/EU will pursue a joint WTO case against China’s tech transfer policies

8:38 pm, February 15, 2018

The Yomiuri Shimbun

Japan, the United States and the European Union are considering jointly filing a case against China at the World Trade Organization over Chinese rules that effectively force foreign companies to transfer technologies to domestic firms, The Yomiuri Shimbun has learned.

The move is aimed at protecting the technologies and other intellectual property of companies that enter the Chinese market.

Japan, the United States and the European Union are working together to curb Chinese policies designed to aid its own companies in the massive domestic market.

The Japan-U.S.-EU side started full-fledged discussions on this issue in January and are preparing to jointly file the case as early as March. In 2012, Japan, the United States and the European Union jointly lodged a formal complaint against China over its restrictions on exports of rare earth metals and other materials, but this latest case would be the first to involve the technology transfer issue.

The Chinese government has established strict capital controls for foreign companies in the automobile and other important industries. Foreign firms seeking to enter the Chinese market cannot avoid setting up joint ventures with domestic companies. Under a regulation that took effect in 2002, after a foreign firm transfers technology to a Chinese company or a joint venture and that technology is then improved inside China, the Chinese firm is allowed to freely use that technology.

This has made it very difficult for Japanese, U.S. and EU companies to keep their unique technologies and confidential information within their own walls. The Japan-U.S.-EU side believes the Chinese regulations, for all intents and purposes, force foreign companies to transfer their technologies, which violates WTO principles that prohibit discriminatory treatment of foreign companies.

As China’s economy has grown, transfers of technology from overseas have also quickly expanded. In 2011, it was revealed that China was preparing to apply for patents overseas for some technologies incorporated into a high-speed train that Chinese companies had developed based on technologies supplied by manufacturers from Japan, Germany and elsewhere.

After the complaint is filed, all nations involved in the case — including China — will hold discussions on the issue. If the problem cannot be resolved at this stage, the process then moves to a WTO dispute settlement panel that examines the case. If the panel decides trade rules have been violated, the WTO will urge China to take corrective steps.

This review could drag on for an extended time, but Japan, the United States and the European Union have decided this issue should not be left unaddressed.

In its “Made in China 2025” initiative announced in 2015, Beijing stated its plan to become a world-class manufacturing superpower. The strategy centers on fields such as electric vehicles, robots and social infrastructure, including electrical power facilities and transport systems. Many Japanese companies are at the forefront of these fields thanks to their technologies, so this has generated a growing sense of urgency over possible technology leaks

Dakle, oni se bune sto su ih Kinezi dostigli u mnogim tehnoloskim sektorima i sada ih prestizu iako su sami pristali na to

Nadam se da ce ovo konacno ubediti elite rusije i kine da prestanu flert sa doticnim zbog sopstvenih privilegija, koje ce izgubiti svakako, i da se krene u ono sto mora da se uradi i zavrsi brzo sa time jer je ionako suvise korumpirano i jadno.

Uzgred, ovo pokazuje da su Kinezi radili skoro sve suprotno od Srbije u razvoju...

- Korisnik

- Posts : 4670

Join date : 2015-02-17

- Post n°184

Re: Ћина-Средње Краљевство

Re: Ћина-Средње Краљевство

Normalno, retko ko do niko je razvio privredu na slobodnom tržištu već protekcionizmom.

- Posts : 10694

Join date : 2016-06-25

- Post n°185

Re: Ћина-Средње Краљевство

Re: Ћина-Средње Краљевство

Ne bas protekcionizmom u punom smislu. Bila bi greska potpuno zatvaranje i to Kina nije radila, stavise.

- Posts : 10694

Join date : 2016-06-25

- Post n°186

Re: Ћина-Средње Краљевство

Re: Ћина-Средње Краљевство

SEC Kills Chinese-Linked Takeover of Chicago Stock Exchange

https://www.bloomberg.com/news/articles/2018-02-15/sec-rejects-chinese-linked-takeover-of-chicago-stock-exchange

Sta ti je slobodno trziste...

https://www.bloomberg.com/news/articles/2018-02-15/sec-rejects-chinese-linked-takeover-of-chicago-stock-exchange

Sta ti je slobodno trziste...

- Posts : 52531

Join date : 2017-11-16

- Post n°187

Re: Ћина-Средње Краљевство

Re: Ћина-Средње Краљевство

Slobodno trziste je za protivnici

- Posts : 10694

Join date : 2016-06-25

- Post n°188

Re: Ћина-Средње Краљевство

Re: Ћина-Средње Краљевство

Cudo gradjevine-najduzi most na svetu sa dodatnim tunelima od Hong Konga do Makao...

- Posts : 41630

Join date : 2012-02-12

Location : wife privilege

- Post n°189

Re: Ћина-Средње Краљевство

Re: Ћина-Средње Краљевство

Ти мостови-тунели су опичена ствар. Требало ми је неколико пролазака да се навикнем. За невољу, први пут кад сам наишао туда, прешао сам два један за другим (Хемптон Роудс па Чесапички). Овај други је засад најдужи што постоји, 37км, што треба издржати, то је таква хипноза да не поверујеш. Пичиш око стотке а ништа се не помера, све исто, испод и око тебе бетон, ван тога вода. Зомбираш се. Срећа у те тунеле па те то расани.

_____

cousin for roasting the rakija

И кажем себи у сну, еј бре коњу па ти ни немаш озвучење, имаш оне две кутијице око монитора, видећеш кад се пробудиш...

- Posts : 41630

Join date : 2012-02-12

Location : wife privilege

- Post n°191

Re: Ћина-Средње Краљевство

Re: Ћина-Средње Краљевство

Mr. Moonlight wrote:ne razumem poslednju rečenicu tvog posta

Након двадесетак минута вожње над водом наиђе део који иде под воду, па се пренеш, одзомбишеш, дођеш мало к себи, возиш мало испод воде, па онда опет над водом, па други тунел, па опет 20 минута над водом и тек онда угледаш копно, јер га дотле заклања ограда... прешао сам тај мост четири пута и једва сам се навикао.

Док нису била два моста, него један са две траке, било је судара само тако. Да неко прође дном и откопа камионе, наватао би се гвожђурије. Трећи део неког акционог филма је требало да буде снимљен на њему, ал' су закључили да је сувише опасно, па су га иснимали из хеликоптера на празно, а онда све снимили на копну те саставили на рачунару.

_____

cousin for roasting the rakija

И кажем себи у сну, еј бре коњу па ти ни немаш озвучење, имаш оне две кутијице око монитора, видећеш кад се пробудиш...

- Guest

- Post n°193

Re: Ћина-Средње Краљевство

Re: Ћина-Средње Краљевство

Kina ukida limit od dva mandata na čelu države. Neće im to ništa valjati.

- Guest

- Post n°195

Re: Ћина-Средње Краљевство

Re: Ћина-Средње Краљевство

Prelazak na ograničeni mandat bio je politička revolucija bez presedana u Kini i doveo je do toga da nemaju haos od 5 godina pri svakoj promeni vlasti.

- Posts : 41630

Join date : 2012-02-12

Location : wife privilege

- Post n°196

Re: Ћина-Средње Краљевство

Re: Ћина-Средње Краљевство

СССР је чак експериментисао са једногодишњим доживотним мандатом.

_____

cousin for roasting the rakija

И кажем себи у сну, еј бре коњу па ти ни немаш озвучење, имаш оне две кутијице око монитора, видећеш кад се пробудиш...

- Guest

- Post n°197

Re: Ћина-Средње Краљевство

Re: Ћина-Средње Краљевство

Pa Kina se sprema za krljanje sa SAD narednih decenija a za to je potrebna stabilna vlast

- Posts : 22555

Join date : 2014-12-01

- Post n°198

Re: Ћина-Средње Краљевство

Re: Ћина-Средње Краљевство

паће wrote:СССР је чак експериментисао са једногодишњим доживотним мандатом.

Cak i tromesecnim dozivotnim mandatom

- Spoiler:

- Posts : 41630

Join date : 2012-02-12

Location : wife privilege

- Post n°199

Re: Ћина-Средње Краљевство

Re: Ћина-Средње Краљевство

Filipenko wrote:паће wrote:СССР је чак експериментисао са једногодишњим доживотним мандатом.

Cak i tromesecnim dozivotnim mandatom

Мислио сам на Черњенка. Колико је он оно саставио?

_____

cousin for roasting the rakija

И кажем себи у сну, еј бре коњу па ти ни немаш озвучење, имаш оне две кутијице око монитора, видећеш кад се пробудиш...

- Posts : 22555

Join date : 2014-12-01

- Post n°200

Re: Ћина-Средње Краљевство

Re: Ћина-Средње Краљевство

Godinu. Ali Berija je odsvirao svoje mnogo brze. Jebiga, hteo da povuce Crvenu Armiju iz istocne Evrope, lud covek.

by Zuper Sun Jan 14, 2018 5:05 am

by Zuper Sun Jan 14, 2018 5:05 am